Saving typically results in you earning a lower return but with virtually no. The biggest difference between saving and investing is the level of risk taken.

Saving Vs Investing The Pros And Cons Of Each Tools To Use

In everyday terminology people refer to investing money in a bank however this does is not investment in an economic sense.

. Saving is the act of setting aside money you would rather not spend now for possible use in the future. Take a closer look at the definition of saving vs investing. Key Differences Between Saving And Investing 1.

Savings accounts are about as risk-free of a financial vehicle as you can get. The biggest difference between saving and investing is the level of risk taken. In contrast investing allows you.

We save for purchases and emergencies. Remember saving money is an important part of being financially successful. Of the so many differences in saving and investing the essential differentiator is the purpose of doing them both.

Saved money is income at disposal set aside for future use. Your money should earn a fairly stable rate of interest and you can typically make withdrawals if you need to. Investment is defined as the act of putting funds into.

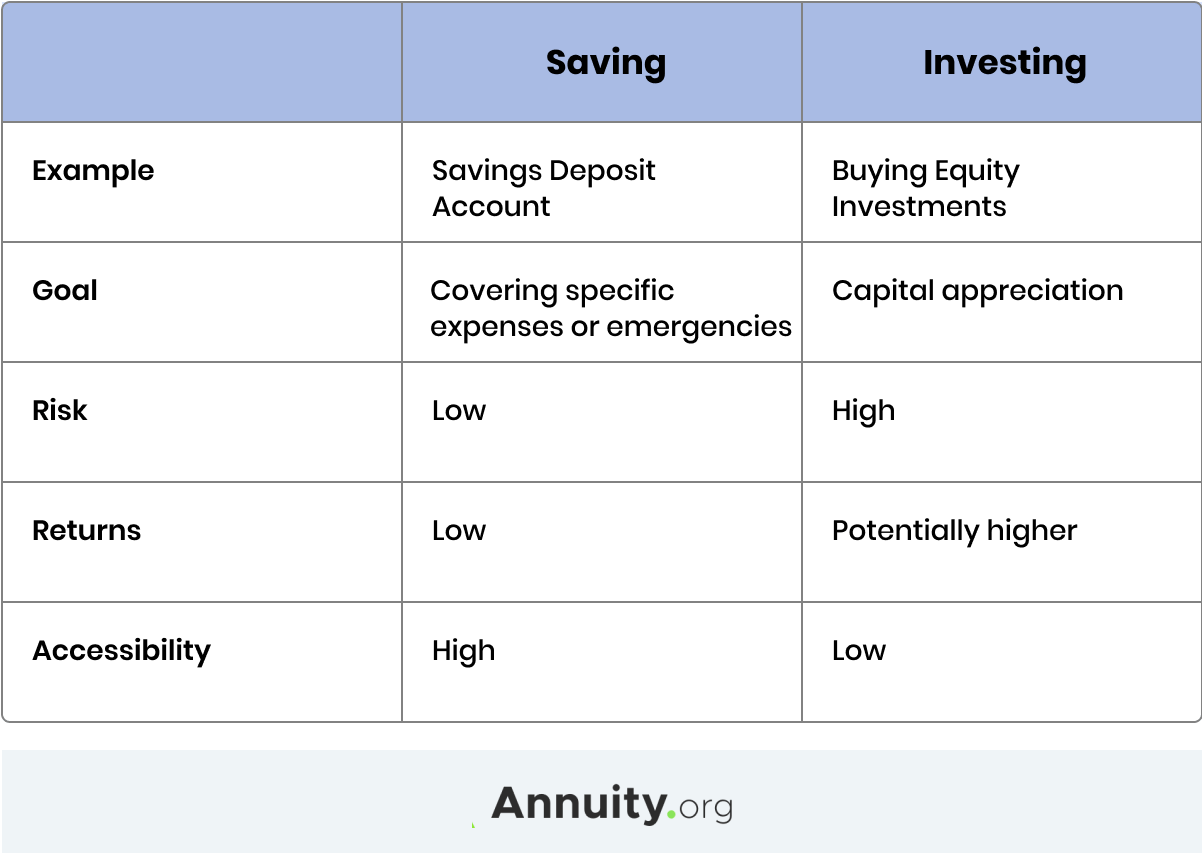

The words saving and investing are sometimes used interchangeably but when it. Depending on the investment investing may provide better returns though with greater risk than savings and more limited access to funds. The money you put into a savings account is more liquid than the money you put into investments.

When you invest you have a greater chance of losing your money than when you save Unlike FDIC-insured deposits the money you invest in securities mutual funds and other similar investments is not federally insured. So its not Saving vs. Investment values can rise and fall.

Whereas savings accounts offer only low yields investing allows you to make higher returns on your saved funds. Saving is setting aside money in safe accounts where it is unlikely to lose value. When taking a risk to double your hard-earned money investing should be your choice.

Why Investing Is Important. The main difference between investing and saving is that investing means to put in money effort or time into financial schemes property or commercial ventures and shares with the expectations of achieving a profit. A savings account for example allows you to access this money at any time without any risk or loss.

Youre not going to lose any money while its in the bank because your deposit is. Though the basic objective of both saving and investment is. Saving is when you put money aside usually in a savings account.

When it comes to deciding whether to save or invest investing offers one giant benefit. When it comes to investing patience is key. Now let us understand the key difference between these similar yet different terms saving and investment.

Investing is putting your money into something specific with the expectation that its value will grow over time providing you with the opportunity to create more wealth. Investing is having a claim on an entity that produces a product or service with the goal of profit and the risk of loss. Investing is different from.

Because investments such as stocks bonds and mutual funds are connected to the financial markets your account values may go up and down according to changes in the economy. Saving is typically done for shorter-term needs where protecting your money and being able to access it easily are top priorities. A savings account generally represents the money you put aside a little at a time typically into a bank account that earns interest and investing generally represents purchasing assets stocks.

You could lose your principal which is the amount youve invested. When you invest you expect to earn money on your investments over timemore than you could earn with a savings account. Investing is taking this a step further and putting money into the stock market by buying stocks bonds mutual funds or other investment vehicles.

Investing or Saving Investing Theyre parts of the same solution. In neo-classical economics it is assumed that the level of saving will equal the level of investment. This is because investment is determined by available savings in the economy.

It is the surplus amount. Investing is usually for longer-term goals where growing your money is the most important goal. The terms saving and investment differ from each other in following ways.

Investing on the other hand can help you work toward reaching your longer-term goals such as retirement or a college fund for your future children or grandchildren. When Should You Invest. The basic differences between savings and investment are explained in the following points.

Investing generally involves putting the original investment at risk with the hope of higher returns than savings. When you open a savings account you start by depositing a lump sum and then contributing regular amounts over time. Saving is associated with reaching your short-term goals.

Investing is absolutely imperative in building long-term wealth. Saving is putting aside money to reach your goals. Savings products may provide greater safety and convenience compared to investing.

Saving typically results in you earning a lower return but with virtually no risk. Saving money typically means it is available when we need it and it has a. Perhaps the most striking difference between savings and investment is the level of risk the account holder takes on.

People save money to fulfil their unexpected expenses or urgent money requirements. Understanding the balance between savings and investing can help you achieve your short- and longer-term goals. Saving refers to the money left over from an individuals income which is kept for later use.

If you invest 1000 into an investment fund and earn an average return of 6 percent each year you. The most significant difference between savings vs investment is in the level of risk. Savings are done so as to provide an emergency fund or go-to fund to the family as and when required.

Investing involves taking on the risk that you could lose your money in exchange for the likelihood that you will earn a return more money on the amount you invest. Savings means to set aside a part of your income for future use.

Saving Vs Investing Venn Diagram Investing Venn Diagram Holiday Word Search

The Differences Between Saving And Investing In 2021 Investing Money Market Account Investment Analysis

Saving Vs Investing Which Is Better Investment Quotes Investing Insurance Investments

Savings Vs Investments Investing Investment Tips Saving Money

0 Comments